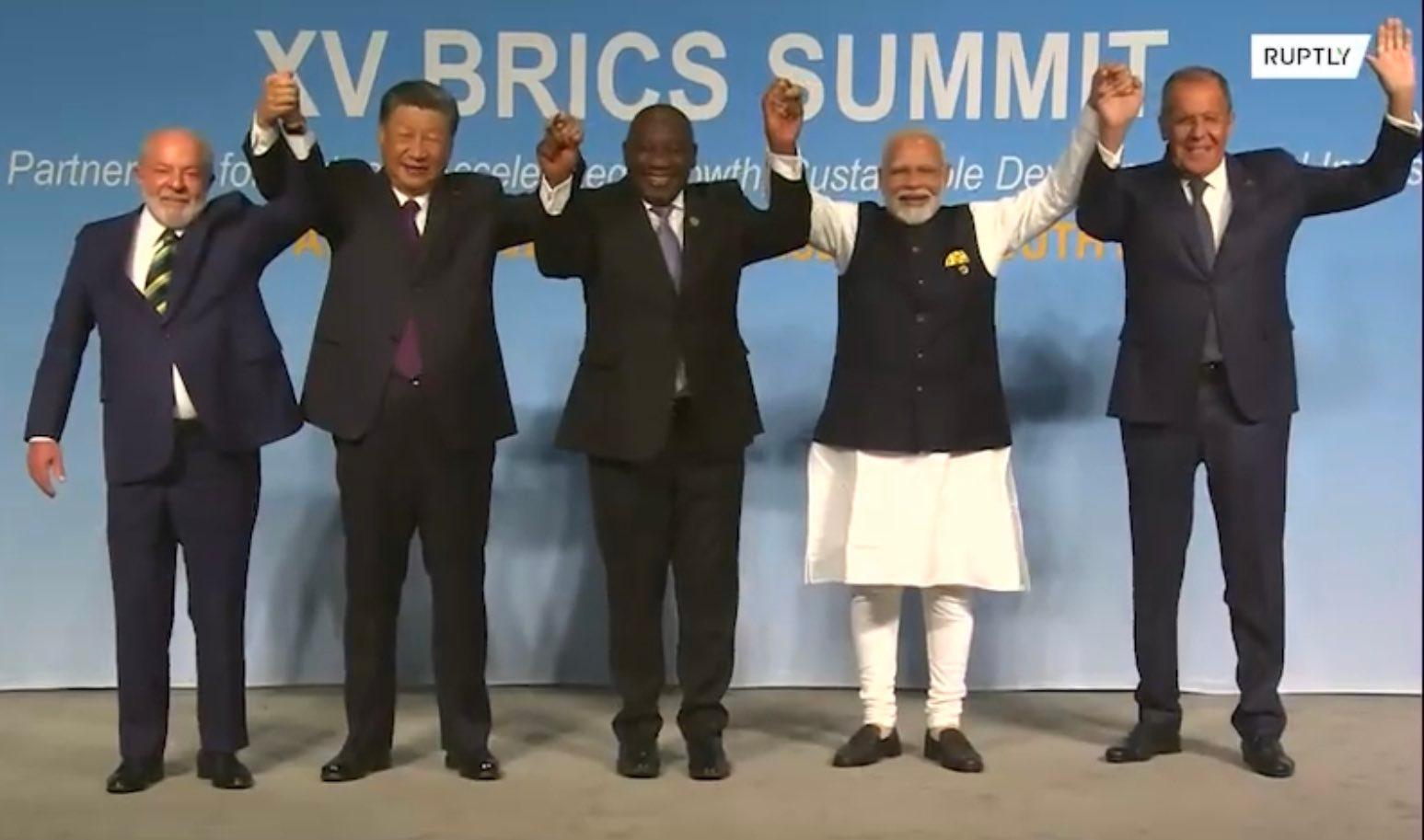

The antagonist gaze over the BRICS’ wall

If Infoaut.org was to attend state exams this year, like a lot of people it would have been in a quandary if it was to follow the outline about Claudio Magris (after almost 20 years of educational butchery and school corporatization from Berlinguer till now, with Gelmini in the middle…)*, nonetheless it could surely have spent some words about the BRICS.

It would have talked about how, after the burst of the US dot com bubble in 2000, huge capitals poured out on the real estate markets of developing countries (the Chinese one above all, at the price of huge environmental havoc) to let accumulation start anew. It would have talked about how other capitals did move to inflate the biofuels’ bubble in Brazil (which now has to raise urban public transport tickets’ prices). It would have talked about how in Russia the foreign currency speculation went hand in hand with the centralization of the productive system in the hands of Putin’s entourage. Hence, it would have tried to contextualize the rise of new global markets and political players in the wake of the increasingly inefficient and destructive tendency of financial and non-financial capitalism dynamics at the expense of 99%.

Now, in the gloomy Western present, capitalist accumulation slows down in European countries, squashed by austerity and German electoral assessments, and recovery is virtual and warped by the permanent liquidity injection in US and Japan**. Because of the international power balance instability, the evergreen trump card of war cannot be unleashed as before; making the Syrian conflict stalemate a Cold War-like skirmish between the decayed blocks of Arab and Russian nationalism against the islamic-capitalist association of Gulf Countries and NATO – played at the expense of the population of that Mediterranean sector.

Therefore, financial fluxes and the growth of profits would enjoy a retreat into the “quiet life” security of the opening and development of always new markets in developing countries: land grabbing, top-down imposition of great works, rise of the cost of living and decrease of its quality (it does ring a bell, doesn’t it?)…But how can all of this happen in an agitated 2013 – that marks how not only the BRICS’ boundary but even that of the “Next 11” (both catchphrases by Goldman Sachs economist Jim O’Neill) developing countries is pervasively reshaped by a geopolitics not of capitals, but of struggles?

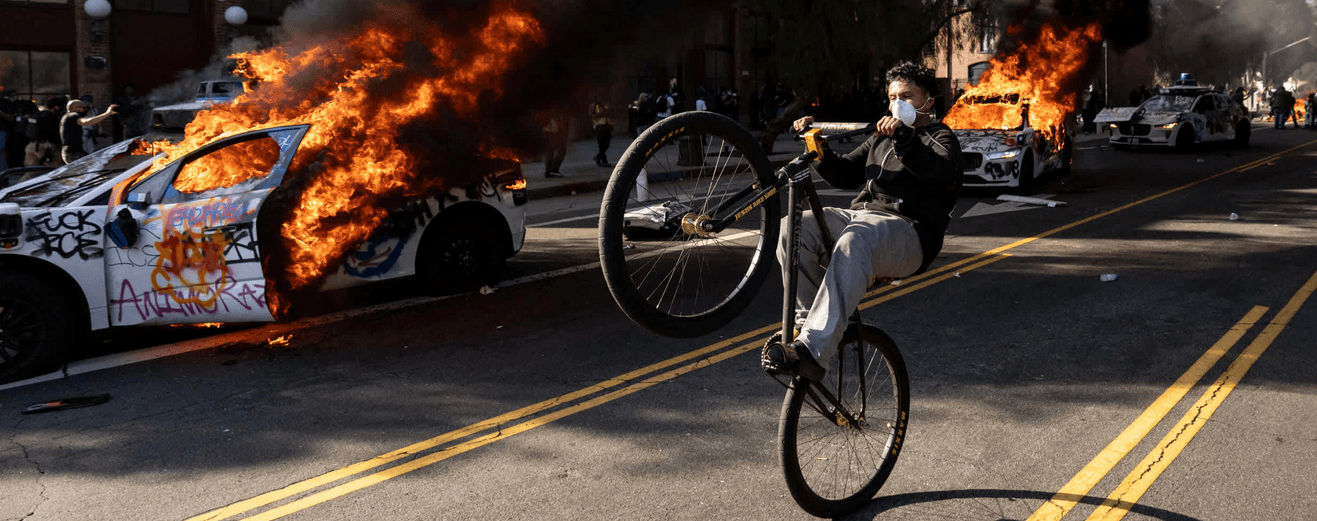

From the claims of the miners in a South Africa at Madiba’s sickbed to the Indian anti-sexist uprising, from environmental struggles in China to the refusal of great events in Brazil, from the protests against fuel price rises in Indonesia to the anti-authoritarian tension in Turkey and Russia, the string-pullers are being more and more hindered and risks for the investments grow: especially when the struggles for “development” rights (better salaries, environment, civil liberties) recompose – as in present time Turkey and Brazil – on the higher (and decisive) level of systemic criticism.

Still, we are dealing with a tendency, to be costantly probed. But one that relies (and, in the Turkish case, pretty well profiting from that) in the first place on the imaginary launched by the movements of 2011, with Occupy Wall Street at their forefront: the possibility for organized territorial struggles to enter a planetary debate with the support of new communication technologies. And thereafter, the opportunity of connecting bottom-up struggles of the developing countries – whose subjectivities reclaim new forms of autonomy against the intrusiveness of the big capitalist projects and the authoritarian forms that support them – and those of the Western countries – where the concession of formal rights stands as a fig leaf in front of the demolition of substantial rights. By building a social strike that can now assume a really global character.

INFOAUT

*A reference about the sorry state of Italian education after 20 years of neoliberal reforms, particularly enforced by the mentioned Luigi Berlinguer and Mariastella Gelmini ministers

**After four years of expansion, shortly after the publication of this article, the FED announced a more contractionary monetary policy

Ti è piaciuto questo articolo? Infoaut è un network indipendente che si basa sul lavoro volontario e militante di molte persone. Puoi darci una mano diffondendo i nostri articoli, approfondimenti e reportage ad un pubblico il più vasto possibile e supportarci iscrivendoti al nostro canale telegram, o seguendo le nostre pagine social di facebook, instagram e youtube.